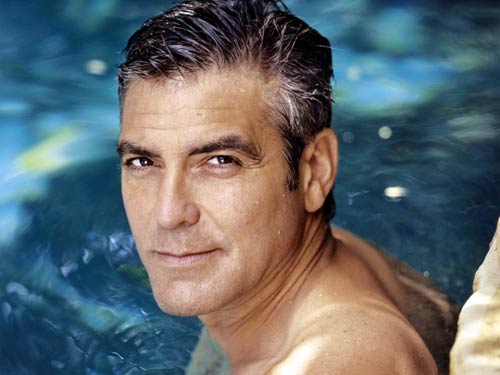

We are all familiar with all the advice on how to get rich. However here I analyse George Clooney’s wealth and provide a possible reason for his wealth. George Clooney apparently earns $15m per film Assume Clooney appears for 60 minutes of a 90 minute film That works out at $250,000 per minute on screen. George likes coffee, in ...